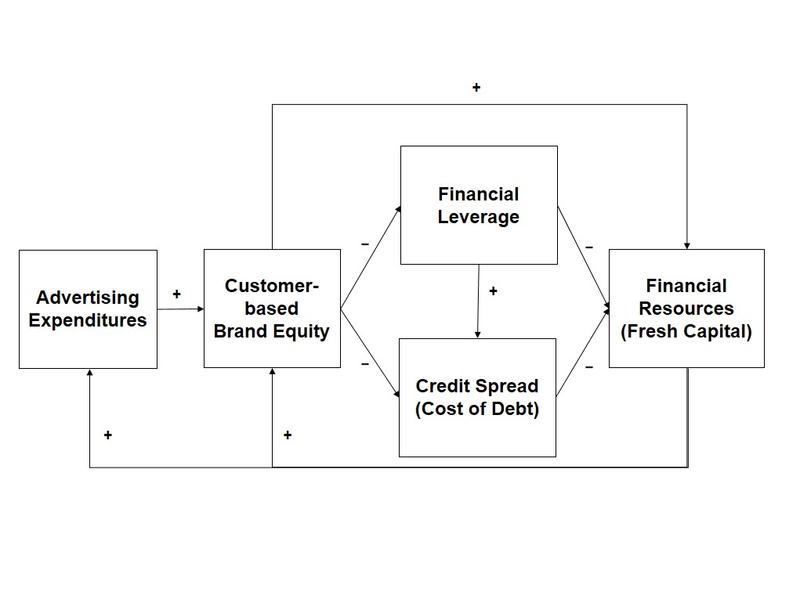

Model of the Financial Brand Value Chain

Diagram: KLU

The Marketing Department’s main goals are to make brands more recognizable and increase sales. The Finance Department’s work is aimed at safeguarding the company’s financial health. Usually, the two departments speak very different languages. Himme and Fischer’s study shows that it would be better if they were pulling on the same rope.

“We show that marketing activities also have a significant impact on the company’s debt ratio and credit rating,” explained Himme. “A strong brand has an effect on key financial variables such as capital costs and access to fresh capital.” In their study, the scientists evaluated the data from 155 companies.

Coining the term “Financial Brand Value Chain”, they show how marketing expenditures impact a company’s financial situation. The higher the investment in advertising and marketing, the higher the customer-based brand equity (CBBE). A higher brand value leads to a lower company debt ratio. After all, a strong brand makes other sources of capital such as the company’s stocks or bonds more attractive to investors. This gives the company greater financial leeway.

And a higher brand value leads credit rating agencies to give the company a better rating. If the company does go into debt, it receives better loan conditions and the costs of borrowed capital are lower. Both the level of debt and the company’s rating from the agencies have an influence on investors’ decisions. A company with a low level of debt and a good rating can acquire fresh capital from investors more easily. On several levels, targeted marketing expenditures help companies to improve their financial situations.

“These findings are new,” said Himme. “For the first time, we are showing that marketing and finance goals are not unrelated but instead, should go hand in hand.” Marketing managers now have new ammunition for their next budget negotiating session. “Our results also indicate that representatives of both departments should get together and work out a joint marketing and finance strategy. This is the only way to achieve optimal results for the company,” added Himme.

He also can quote a few statistics to back up his scientific findings: “If you apply our findings to an average company from our study with annual revenues of $13 billion, a 10% increase in CBBE will translate into a $240 million increase in financial resources.” Himme also says that at the same time, a 10% increase in the market value at this representative company would mean annual interest savings of $58 million.

“Financial Brand Value Chain: How brand investments contribute to the financial health of firms” can be viewed in the pre-print section of the International Journal of Research in Marketing:

http://dx.doi.org/10.1016/j.ijresmar.2016.05.004

For media inquiries:

Kristina Brümmer

kristina.bruemmer@the-klu.org

+49 40 32 87 07-152