Eurex integrates Markit dividend forecasts in pricing models to further enhance derivative prices

Eurex, the world's largest derivatives exchange, and Markit Group Limited (“Markit”), the leading industry source of independent data, portfolio valuations and trade processing for the OTC derivative markets, today announced that Eurex has integrated Markit’s dividend forecasts into Eurex's calculation of settlement prices.

Markit's dividend forecasts will enhance the exchange’s determination of settlement prices by providing clients with improved dividend information out to four years ahead, based on detailed analysis and research.

Eurex is jointly operated by Deutsche Börse AG and SWX Swiss Exchange, and is the market place of choice for electronic trading and clearing of derivatives. Eurex's clearing house is responsible for determining settlement prices for all products listed on the Eurex trading platform. The exchange currently provides settlement prices for more than 600 equity-related products daily.

Markit Equities is the industry standard in dividend forecasting, and provides individual dividend amounts and ex-dividend dates for over 4,600 stocks globally. Markit provides benchmark data for the global financial and commodity derivative markets, and its services are used by over 600 institutions to enhance trading operations, reduce risk and manage compliance.

John Price, Managing Director and Head of Markit Equities, said: “We are delighted that Eurex has integrated Markit’s dividend service as an input to their derivative pricing models. The service is increasingly recognised as the industry benchmark, and users will benefit from information which takes into account the likely volatility of dividend payouts.”

Peter Reitz, Member of the Executive Board of Eurex, commented: “Eurex has actively increased its equity-based product range this year with the introduction of Single Stock Futures contracts on all 370 Euro and Swiss Franc-denominated components of the Dow Jones STOXX 600 index and the introduction of additional equity options, bringing the total number of equity options available on Eurex to 180. This broader range of equity derivative products has meant an even greater need for accurate dividend forecasts, given their impact on settlement prices. In recognition of the increased importance of reliable input data, and in order to maintain our leading role in the exchange-traded equity markets, Eurex has integrated Markit’s benchmark dividend forecasts in all proprietary equity pricing models.”

For further information, please contact:

Markit Group Limited

Teresa Chick Director,

Corporate Communications

Tel: +44 20 7260 2094

Email: teresa.chick@markit.com

Eurex

Candice Adam

Corporate Communications

Tel: +44 20 7862 7239

Email: candice.adam@deutsche-boerse.com

About Markit

Markit Group Limited is the leading provider of independent data, portfolio valuations and OTC derivatives trade processing to the global financial and commodities markets. The company receives daily data contributions from over 70 dealing firms, and its services are used by over 600 institutions to enhance trading operations, reduce risk and manage compliance. Markit's recent acquisition of MarketXS, a leading provider of real-time technology and trading solutions to the financial services industry, will power the distribution of its data and services.

Markit's position in the derivatives markets has been acknowledged by the industry with awards from Credit for Best Operational Support Services Provider 2006; Inside Market Data for Reference Data Provider of the Year 2006, and Company to Watch 2006; Risk Magazine for Trading Initiative of the Year 2006 (Credit Event Fixings); Structured Finance International’s Editor's Award for Advancing Structured Finance 2006; International Securitisation Report's Editor's Award for Innovation 2005; International Financing Review’s Innovation of the Year 2005 (Credit Event Fixings); Financial News' Best Derivatives Data Provider 2005; and Institutional Investor’s Operations Management Award for Vendor of the Year 2005. For more information, see www.markit.com

About Eurex

Eurex is the world's largest derivatives exchange and is jointly owned and operated by Deutsche Börse AG and SWX Swiss Exchange. Eurex offers a broad range of international benchmark products and operates the most liquid fixed-income derivatives markets in the world. Furthermore, Eurex is the leading exchange for trading in European equity options and offers options on approximately 180 stocks as well as 370 single stock futures. In addition to operating a fully electronic trading platform, Eurex provides an automated and integrated clearing house, Eurex Clearing. For more information, see www.eurexchange.com

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Bringing bio-inspired robots to life

Nebraska researcher Eric Markvicka gets NSF CAREER Award to pursue manufacture of novel materials for soft robotics and stretchable electronics. Engineers are increasingly eager to develop robots that mimic the…

Bella moths use poison to attract mates

Scientists are closer to finding out how. Pyrrolizidine alkaloids are as bitter and toxic as they are hard to pronounce. They’re produced by several different types of plants and are…

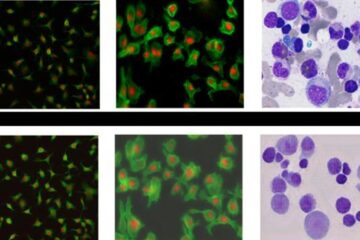

AI tool creates ‘synthetic’ images of cells

…for enhanced microscopy analysis. Observing individual cells through microscopes can reveal a range of important cell biological phenomena that frequently play a role in human diseases, but the process of…